Table of Contents

- When can you initiate EPF withdrawal?

- Documents Required for PF Withdrawal

- What is EPF Withdrawal Form/Composite Claim Form

- EPF withdrawal with a physical application

- EPF withdrawal online

- Benefits of EPF Withdrawal Online

- EPF Withdrawal – FAQs

Withdrawing PF? Doing This Will Help You Avoid TDS

PF or Provident Fund is a retirement corpus for employees. In other words, employees who have contributed towards PF during the course of their employment get funds after retirement. Not only that, employees can withdraw PF funds even before retirement.

But what if PF is to be withdrawn within 5 years of account opening? While it’s allowed, one would have to note that TDS (Tax Deducted at Source) is applicable. As per the rule, a 10% TDS is levied if the EPF account is linked to PAN, 20% if it’s not. However, it’s important to note that TDS isn’t levied if the withdrawn sum is below INR 50,00. That said, TDS is applicable if the amount withdrawn by the account holder — who earns INR 2.5 lakh as annual income — exceeds INR 50,000.

To avoid TDS if the PF sum is above INR 50,000 and annual income is below INR 2.5 lakh, the subscriber will have to furnish either Form 15G or Form 15H; the former for those aged below 60 years and the latter for senior citizens.

When you received your first salary slip, you must have seen a deduction bracketed for PF. That deduction is your contribution to the Employee Provident Fund or EPF.

EPF is a compulsory scheme instituted in all companies, wherein employees must give a portion of their salary to their retirement fund. The employer also contributes the same amount to the fund, allowing the employees to lead an independent life once they stop working. The amount accrued in the EPF earns an annual interest and serves as a corpus during retirement.

As it is a mandatory scheme, employees cannot withdraw the EPF amount until they have retired. However, as we all come across milestone events that compel us to rely on our savings, there are some cases when this rule to EPF withdrawal is not applicable.

Today, we will discuss when and how EPF withdrawal can be done to meet any urgent needs. But before that, we must understand the Universal Account Number or UAN.

According to the Provident Fund Act, an employee in their lifetime will have only one PF account maintained by the Employees’ Provident Fund Organisation (EPFO), which will be operational even as they switch jobs. This account is called the UAN. It is connected to the employee’s PF account within an organisation, giving them the freedom to change companies without having to do an EPF transfer between them.

New EPF Withdrawal Rules 2022

- Like a savings account, funds from your EPF profile cannot be withdrawn while employed. The EPF happens to be a lengthy retirement funds plan. Only after retiring may the funds be retrieved.

- Partial withdrawals from EPF funds are permissible in the event of a crisis, including a medical crisis, the acquisition or building of a home, or the pursuit of higher learning. Partial removal is subject to restrictions based on the cause. The account owner can seek a partial transfer online.

- Even though the EPF capital may only be taken after retiring, retirement plans are not recognized until the individual reaches a certain age which is fifty-five. EPFO enables a drawdown of 90 percentage points of the EPF capital one year before retiring if the individual is at least fifty-four years old.

- In case an individual becomes unemployed owing to a deadbolt or layoff, the EPF capital might be retrieved.

- To collect the EPF payment, the EPF member must declare bankruptcy.

- According to the new regulation, EPFO authorizes withdrawals of 75percentage points of your EPF capital after one month of being unemployed. After finding new work, the leftover 25percent of total capital can be switched to a different EPF profile.

- According to the former regulation, after two months of being unemployed, you can withdraw your whole EPF balance.

- Tax exemption upon EPF fund is only available if a worker contributes to their EPF profile for 5 consecutive years. In case there is a gap in contributions to the portfolio for 5 consecutive years, the worker’s EPF balance is taxed. In that instance, the whole EPF balance will be deemed tax liability for the fiscal year.

- When an EPF corpus is withdrawn prematurely, taxes are withheld at the origin. TDS isn’t applied if the total amount is below Rs fifty thousand. The relevant TDS amount is 10percentage points if a worker supplies PAN along with the request. Alternatively, it will be 30% + taxes. File 15H/15G is a statement document that declares that a user’s whole earnings are not chargeable and that the TDS can thus be avoided.

- Employees no longer have to keep waiting for clearance from their boss to receive their EPF funds. It is possible to do it immediately through the EPFO if the individual’s Aadhaar and UAN are connected and the company has permitted it. The status of an EPF transfer may be verified online.

Tax-Free Limit for PF Withdrawals

In case a person can delay removing cash from their funds for 5 constant years subsequent transactions will not be subject to TDS. TDS isn’t charged if the transaction sum is below Rs 50,000.

Types of PF Withdrawals

Participants who have joined EPFO and linked the Aadhar card data with the UAN are eligible for 3 kinds of PF redemptions:

- PF Final Agreement – Release when one reaches the age of retirement and then when their job is terminated.

- PF Partially Withdrawn – A transfer made in the event of a catastrophe.

- Withdrawal of pension benefits.

EPF Withdrawals — All you Need to Know

The following are the major changes to the EPF withdrawing rules:

- Only after the threshold of 54, you can receive 90% of your EPF amount.

- After quitting the organization, an individual can receive 75% of his pension scheme amount if he is jobless for one month, as well as the remainder 25% just after 2nd month.

When can you initiate EPF withdrawal?

When you are not drawing a salary, it makes no sense to maintain an EPF fund. Hence, you are entitled to the full EPF amount when:

- You have retired from the workforce

- You are not employed for 2 months or more

There are, however, other scenarios too in which you can make a partial EPF withdrawal from your hard-earned savings. These include:

- Marriage – If you have been in service for 7 years, you can withdraw up to half of the employee’s quota of EPF fund for yours or your children’s or your sibling’s marriage.

- Education – If you have been in service for 7 years, you can withdraw up to half of the employee’s quota of EPF fund for your education.

- Land purchase – If you have been in service for 5 years, you can withdraw up to 2 years of your monthly pay along with the Dearness Allowance to purchase land in your or your spouse’s name or jointly.

- House purchase or construction – If you have been in service for 5 years, you are free to withdraw up to 3 years of your monthly pay along with the Dearness Allowance for the purchasing or constructing of a house in your or your spouse’s name or jointly.

- Home loan – If you have been in service for 10 years, you can withdraw up to 90% of the entire EPF balance (employer and employee contributions included) for a home loan, provided there is, at least, Rs. 20,000 in the fund inclusive of interest. Further, the property must be in your or your spouse’s name or jointly in both your names and you should be able to produce any documents that the EPFO requests.

- House renovation – If you have been in service for 5 years, you can withdraw up to 1 year of your monthly pay for renovating your house, provided it’s in your or your spouse’s name or jointly owned by both.

- Early Retirement – Once you reach 57 years of age, you can opt for early retirement and withdraw up to 90% of the balance including the interest.

Documents required for PF withdrawal

The documents required to withdraw money from your PF account are listed below:

- Form 19

- Form 10C and Form 10D

- Form 31

- Bank account statement

- Identity proof

- Address proof

- A blank and cancelled cheque with IFSC code and account number. Also, you should ensure that the cheque provided by you is a single account holder cheque

- Two revenue stamps

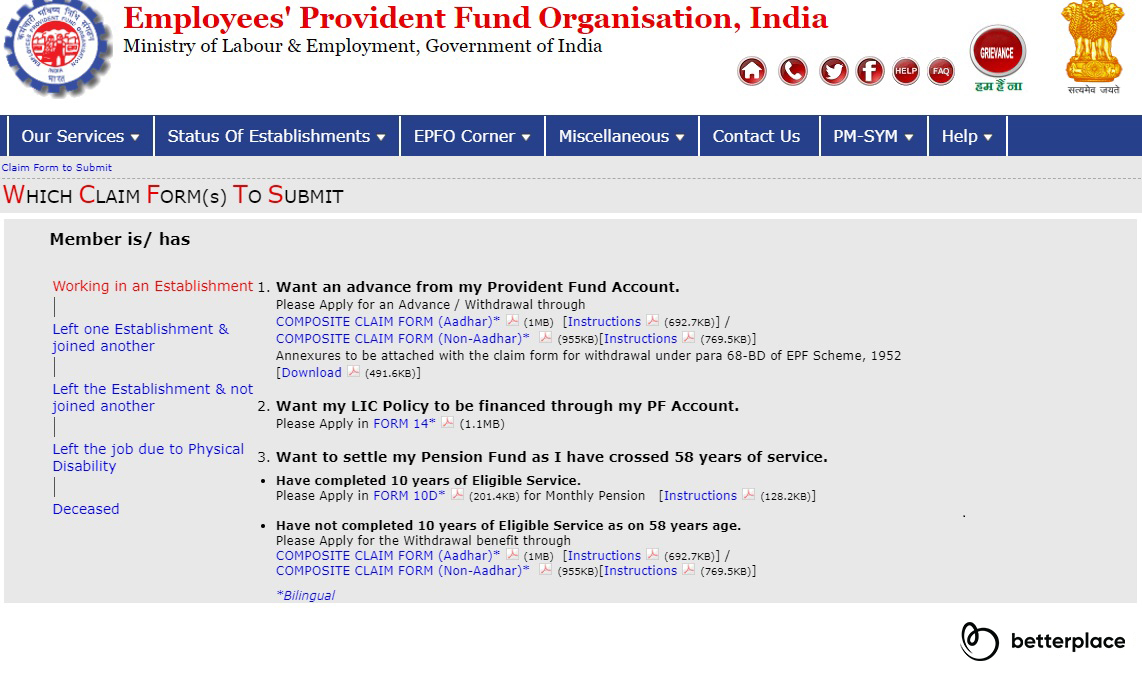

What is EPF withdrawal form/composite claim form

The Composite Claim Form (CCF) can be of use if you want to withdraw your PF money partially or completely. It can also be used to withdraw money from your EPS account. There are two types of CCF based on whether you have an Aadhaar number or not. They are — Composite Claim Form ( Aadhaar) and Composite Claim Form (Non- Aadhaar).

If you have submitted Form-11 to your employer, you can elect to fill in the Composite Claim Form (Aadhaar) form. By submitting the Form 11, your bank details and Aadhaar number are already linked with your UAN and its activated.

The form along with a cancelled cheque can be submitted at the EPFO office. Attestation of the claim form from the employer is not required for the submission. The payment will be credited to your UAN linked bank account.

What is the process for EPF withdrawal?

To able to draw money from your EPF fund, you can do one of the following:

- Submit a physical application for EPF withdrawal

- Follow the EPF withdrawal online procedure

EPF withdrawal with a physical application

You can get the form from the EPF portal and print out and fill the physical application.

The composite claim form with your Aadhar details does not need your employer’s attestation, but the Non-Aadhar form will need it. Once you have filled the form, you need to find your jurisdictional EPFO office and submit it there.

EPF withdrawal online

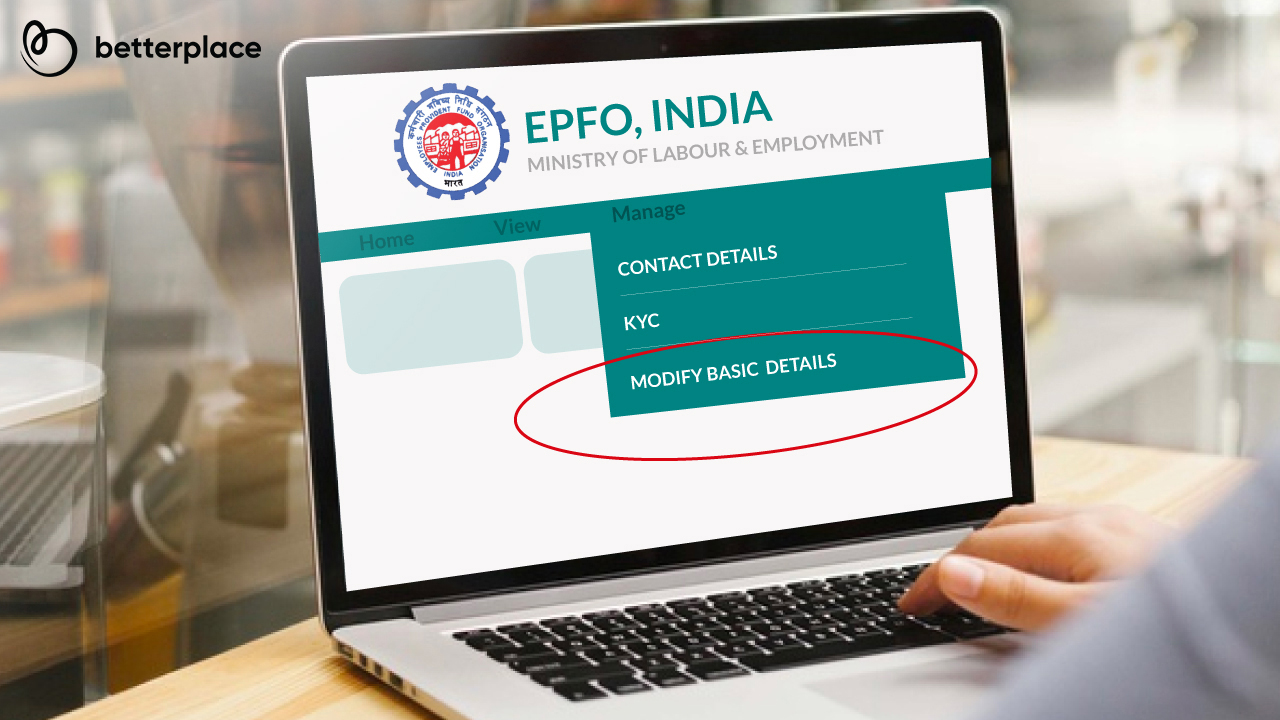

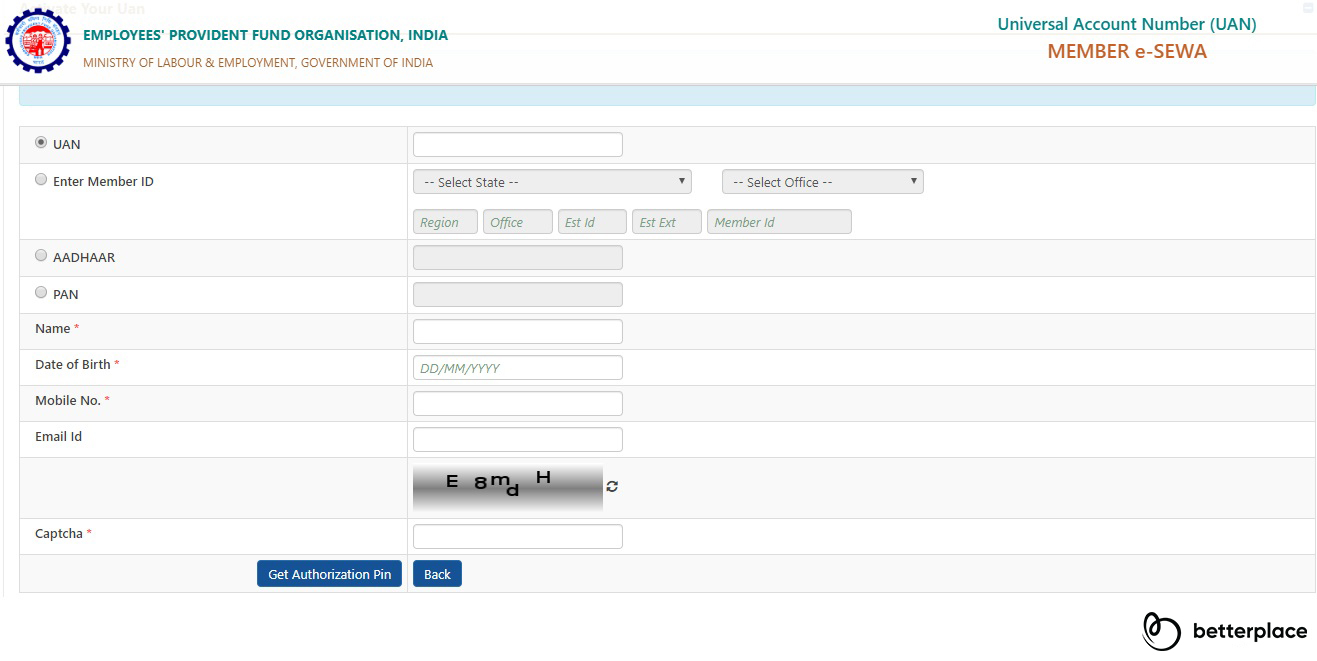

Step 1) To initiate EPF withdrawal online, you first need to activate your UAN at the UAN member portal.

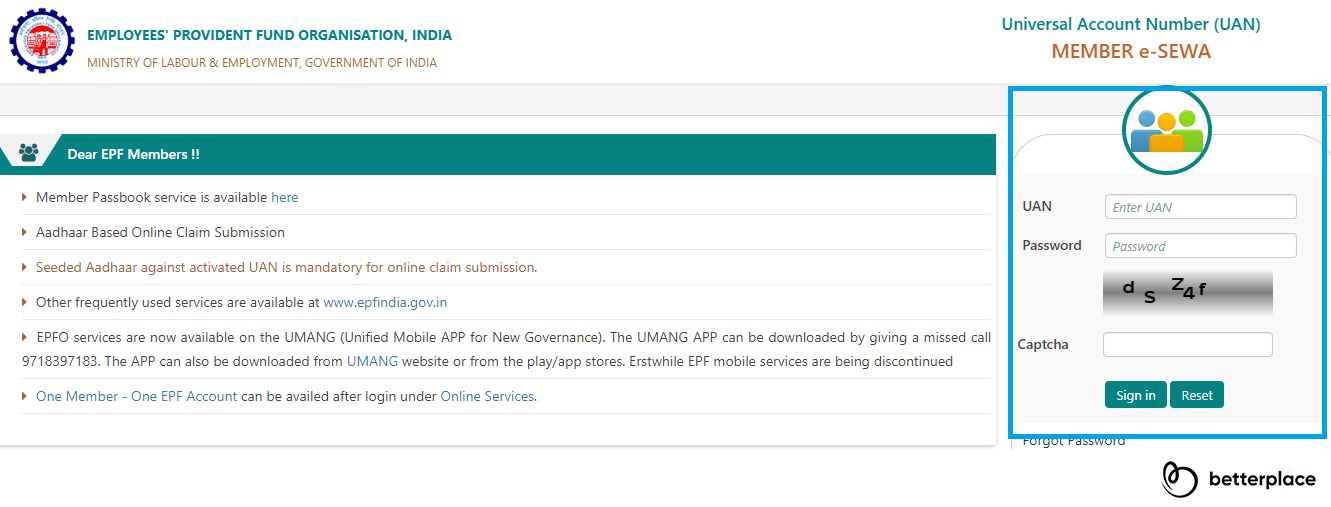

Step 2) Then, input your UAN, your password and the Captcha to sign in.

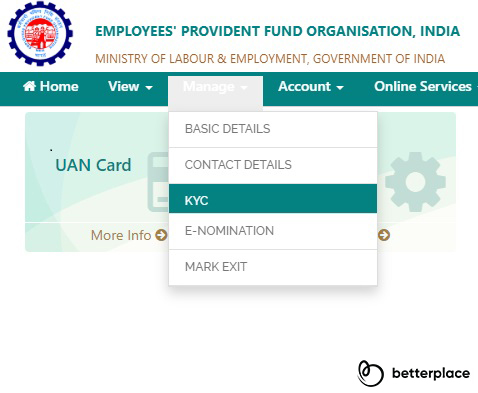

Step 3) Once you have logged in, check if your KYC details are updated in the Manage tab.

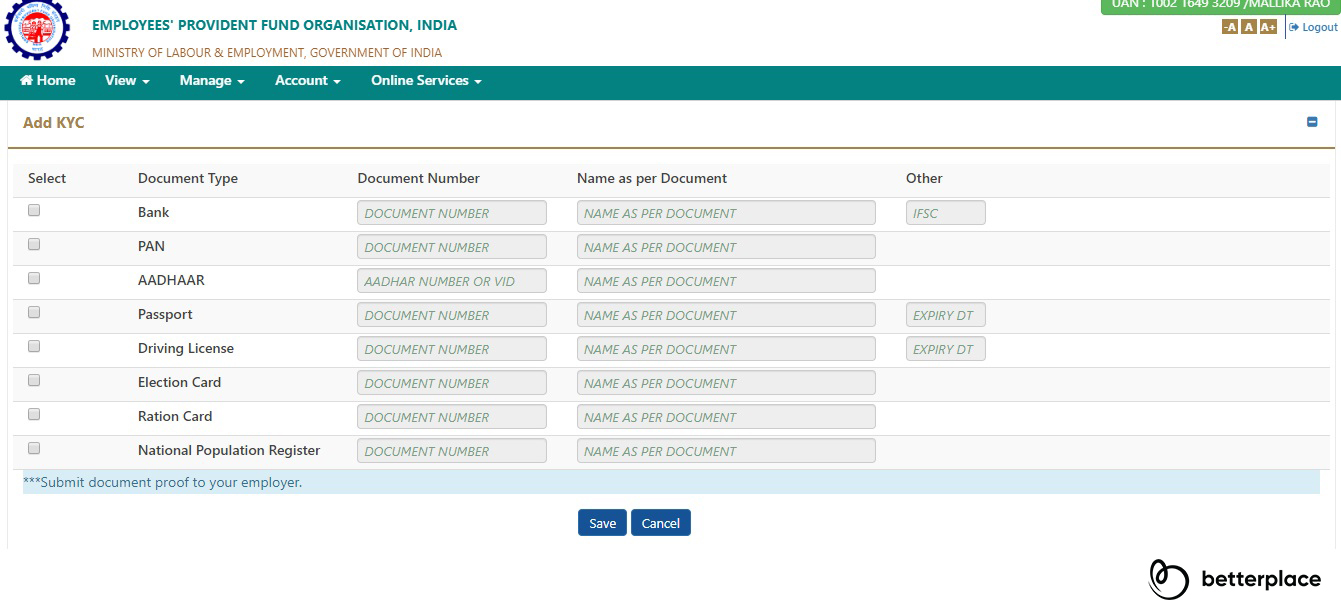

Step 4) Fill all the relevant details, then save, and make sure they are verified.

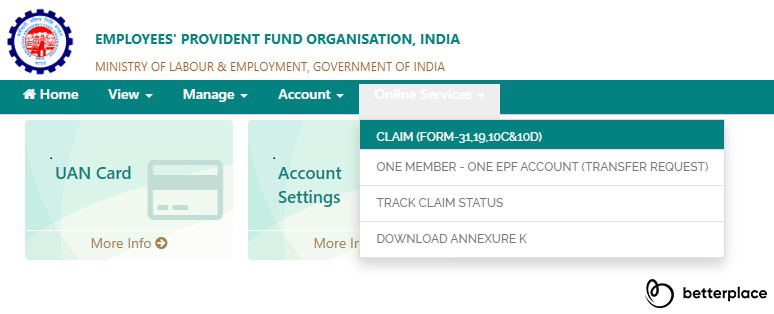

Step 5) On the navigation menu, from the ‘Online Services’ dropdown, select the ‘Claim’ option.

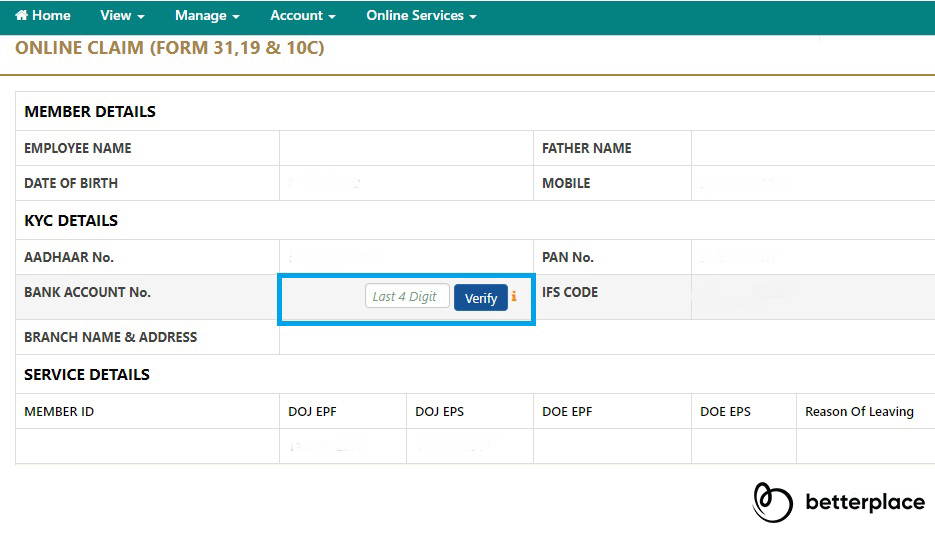

Step 6) On the Claim form, you will be asked to verify the last four numerals of your bank account number.

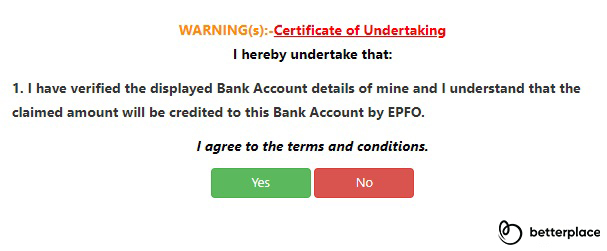

Step 7) Once you have verified the account details, you will get the following confirmation message:

Step 8) Select Yes, and hit the ‘Proceed for Online Claim’ button.

Step 9) In the form, only those options that are applicable to you will show. From the “I want to apply” tab, select the claim you need – full EPF settlement/pension withdrawal/EPF part withdrawal, etc.

Step 10) Select PF Advance (Form 31) and provide the details of the amount you need, the reason to withdraw, etc.

Step 11) Click on the certificate to submit your application.

Once you have submitted the application, the EPFO may reach out to you for further documents or scanned copies. Then, the employer must authorise the request for the EPF amount to be credited in your account. The entire process, including verification and approvals, can take up to 20 days.

Online services failure causes

Here are some important reasons why online EPF withdrawal services fail.

- If the bank account you wish the pf amount to be credited is different from the bank account registered with the EPFO, you will need to link your present bank account through your employer before attempting the EPF withdrawal procedure online.

- Your UAN portal and registered Aadhar mobile number should be the same and in service as you will receive the authentication number on that number only. If the number is no longer in service, change your mobile number on the Aadhar database first.

- Ensure your EPFO database or the UAN member portal contains the exact same details as the Aadhar database. If not you will have to do the EPF process of withdrawal in the offline mode.

Benefits of EPF withdrawal online

Withdrawing EPF via an offline process can be a tiresome and time-consuming task. Long queues and employer visitations can make the process even worse. Withdrawing EPF via an online process is more beneficial than the offline process. Here are some of the major advantages of withdrawing EPF online:

- Seamless processing

- Saves time visiting the EPFO office

- Minimal processing time

- No need for previous employer verification

Taxation on EPF withdrawal

The money withdrawn from EPF accounts can be exempt from tax under certain conditions. They are:

- Contribution period must be over 5 years.

- There should be no break in the 5 years.

- Tax deducted at source (TDS) is deducted on the premature withdrawal only if the amount exceeds Rs. 50,000.

- TDS deduction will be 30% plus tax if the employee hasn’t updated his/her PAN card. It is 10% otherwise.

- If their total income is not taxable, the employee should submit the Form 15H/15G as a declaration.

- If the PF fund is transferred to NPS, he /she won’t be liable to pay tax on withdrawal.

- The liable tax depends on the employee’s salary in the withdrawal year.

- Employees who have claimed tax exemptions on EPF for Section 80C are not eligible for tax exemptions. They should pay tax on employee’s contribution, employer’s contribution and interest on each deposit.

EPF withdrawal – FAQs

- Whether the employee is required to be registered on Member Portal to file the Online Transfer Claim online?

Yes, employees should register on the Member Portal to file the Transfer Claim online. - What are the prerequisite conditions to file the Transfer Claim online?

(a) Member IDs (Both previous and present)

(b) The employer should have registered the digital signature certificate of his authorized signatories. - Can I withdraw PF amount without PAN?

Yes, but in such cases the amount is subject to TDS deduction of 30% . - Is there any enquiry number for EPF withdrawal?

Reach out to EPFO experts on their Toll Free Customer Care Number- 1800 118 005. - Can I withdraw money from EPF for the same reason more than once?

You can withdraw EPF amount for a similar reason for maximum 3 times.

Latest news related EPF withdrawal

EPF Contributions To Be Deducted at 24% from August 1, 2020

August 01, 2020: Monthly EPF contribution brought down to 20% for May, June and July 2020 will now go back to its erstwhile figure of 24% starting August 1, 2020. The contribution — split equally at the rate of 10% between the employer and employee — was introduced to ease the financial burden caused by the pandemic on both the employers and employees. According to the labour ministry, the move — meant to increase employees’ take-home pay and help employers save money — was to benefit 4.3 crore employees/EPF members employed 6.5 lakh establishments. The ministry’s FAQ also stated that the employer will also have to pay 4% as a part of the employees salary if EPF contribution is as part of the CTC. For those who have opted for VPF, unless it is stopped, the VPF deduction and higher EPF will be deducted from the salary starting August 2020.

June 15, 2020: Employees Provident Fund Organisation (EPFO) has replaced the existing system of geographical jurisdiction of claim processing with multi-location claim settlement facility. The labour ministry in its statement said that EPFO offices can now settle claims from any of the regional offices irrespective of the location. This move allows offices with lesser workload to share the burden of other offices which have recorded a high number of pending claims and settlements brought on by the Covid-19 advance. This initiative processes online claims such as PF, pension, transfers, and partial withdrawals.

Related Articles