Table of Contents

- Form 15G and 15H

- Eligibility conditions to fill Form 15G & Form 15H

- Difference between Form 15G and Form 15H

- Download Form 15G and Form 15H

- How to fill Form 15G?

- Submission of Form 15G & Form 15H

- FAQs – Form 15G & Form 15H

Have you kept deposits in your nearest bank? And are you gaining interest out of it? If yes, then you may be liable for TDS deduction on the interest earned from your bank deposits, including your fixed deposits as well as recurring deposits.

TDS stands for Tax Deducted at Source. As per the law, banks should deduct TDS on the interest earned, if the interest earnings are over Rs. 40,000/- annually. Your bank will add up all the deposits in your name in all their branches before calculating your annual interest income. Accordingly, deducts the TDS if the interest exceeds the minimum taxable income limit.

However, if the total yearly income, including the interest earned from deposits, is lower than the annual taxable limit, then you can request your bank to seek exemption or immunity from TDS by submitting Form 15G. Senior citizens should submit Form 15H.

For the financial year 2019-20, the validity of the submission period for Form 15G and 15H is extended up to 30 June 2020. Let us check out other information you need to know about Form 15G and 15H.

Form 15G and 15H

An Indian citizen who wants exemption from TDS deduction on the interest earned from their deposits should submit Form 15G before the validity period ends. If you are a senior citizen, you should file Form 15H; however, you need to meet certain eligibility conditions. You can submit the forms online as well via the bank’s official website. PAN is compulsory to apply for exemptions.

Form 15G and 15H are both valid only for the current financial year. Therefore, you must submit the forms at the start of every financial year to ensure that TDS is not deducted from your interest earnings.

Listed below are some of the important dates to remember for the submission of these forms:

- Due to the COVID-19 outbreak, the government of India has extended the time of Form 15G and 15H till 30 June 2020.

- For the financial year 2019-20, individuals can submit Form 15G and 15H till the first week of July 2020.

Eligibility conditions to fill Form 15G

- You should be an individual, HUF (Hindu Undivided Family), trust or another assessee; a firm or company cannot fill the form.

- For the financial year 2019-20, Form 15G and 15H submission are valid till 30 June 2020. And they are valid proofs for exemption from TDS deduction for the period from 1 April 2020 to 30 June 2020.

- You should be a resident citizen of India.

- Your age must be under 60 years.

- Your total annual income, including the interest, should be below the minimum taxable income limit.

- The total annual interest income should be below the tax exemption limit. For FY 2019-20, the taxable limit is Rs. 2,50,000/-.

Eligibility conditions to fill Form 15H

- You should be an individual or HUF or trust or any other assessee but not a firm or company.

- You should be a resident citizen of India.

- You are above 60 years of age or will reach 60 during the current financial year.

- Your total annual income, including the interest, should be below the taxable income limit.

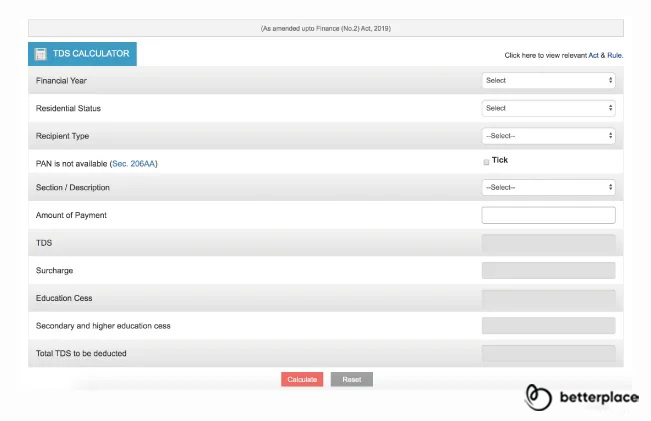

Check out your total payable tax with the TDS Calculator. It will look like this:

Examples that explain who may submit forms 15G and 15H

Example 1

| Person / Category | A |

| Age | 50 years |

| Salary | Rs. 1,80,000 |

| Pension | – |

| FD interest income | Rs. 85,000 |

| Total Income before deductions | Rs. 2,65,000 |

| Deductions under section 80 | Rs. 45,000 |

| Taxable income | Rs. 2,20,000 |

| Minimum exempt income | Rs. 2,50,000 |

| Eligible to submit Form 15G | Yes |

| Eligible to submit Form 15H | No |

| Explanation | Form 15G can be submitted as age is less than 60 years. Total tax is nil, and the interest income is less than the minimum exempt income. |

Example 2

| Person / Category | B |

| Age | 21 years |

| Salary | – |

| Pension | – |

| FD interest income | Rs. 2,60,000 |

| Total Income before deductions | Rs. 2,60,000 |

| Deductions under section 80 | Rs. 30,000 |

| Taxable income | Rs. 2,30,000 |

| Minimum exempt income | Rs. 2,50,000 |

| Eligible to submit Form 15G | No |

| Eligible to submit Form 15H | No |

| Explanation | Form 15G cannot be submitted since the interest income is more than the basic exemption limit. |

Example 3

| Person / Category | C |

| Age | 65 years |

| Salary | – |

| Pension | Rs. 1,00,000 |

| FD interest income | Rs. 1,80,000 |

| Total Income before deductions | 2,80,000 |

| Deductions under section 80 | Rs. 10,000 |

| Taxable income | Rs. 2,70,000 |

| Minimum exempt income | Rs. 3,00,000 |

| Eligible to submit Form 15G | No |

| Eligible to submit Form 15H | Yes |

| Explanation | Form 15H can be submitted if age is more than 60 years, and tax calculated on total income is nil. |

Example 4

| Person / Category | D |

| Age | 68 years |

| Salary | – |

| Pension | – |

| FD interest income | Rs. 3,30,000 |

| Total Income before deductions | Rs. 3,30,000 |

| Deductions under section 80 | Rs. 55,000 |

| Taxable income | Rs. 2,75,000 |

| Minimum exempt income | Rs. 3,00,000 |

| Eligible to submit Form 15G | No |

| Eligible to submit Form 15H | Yes |

| Explanation | Form 15H can be submitted as age is more than 60 years, and tax calculated on total income is nil. Form 15H can be submitted, although interest income exceeds the basic exemption limit. |

What if you forgot to fill Form 15G or 15H?

If you forgot to fill Form 15G and 15H and your bank has deducted the TDS, then you could do the following:

- Income tax returns filing to claim a refund of the deducted TDS

Banks and all other agencies who deduct TDS cannot refund the amount as they deposit this amount directly to the income tax department. In this case, filing your income tax returns filing is the best way to claim a refund of the excess TDS deducted on your interest. The income tax department will refund the TDS amount after you file the IT returns.

- Submit the Form 15G and 15H immediately

Majority of the banks deduct TDS quarterly. Therefore, if you have forgotten to submit the Form 15G and 15H, then do so immediately at the bank or on their website, to avoid any further TDS deductions.

What is the difference between Form 15G and Form 15H

We understand the key differences between forms 15G and 15H by comparing the two side-by-side below followed by an example.

|

Difference between forms 15G and 15H |

|

| Form 15G | Form 15H |

| To be filed by applicants aged 60 years or less | To be filed by applicants aged 60 years or more |

| Applicable for both individuals and HUF | Only applicable for individuals |

| Annual income of individuals or HUF must be lower than the minimum exemption | Form can be submitted by senior citizens regardless of their annual incomes |

Download Form 15G and Form 15H

You can download both the forms from the official Income Tax Portal. In the other scenario, some banks also allow you to download the form from their portal for which you need to check with your official banking partner.

Here are the download links to forms 15G and 15H on the Income Tax Portal.

How to fill Form 15G?

Upon downloading Form 15G, you’ll see that it has two parts. Part I is to be filled out by you whereas Part II is to be filled out by the deductor ( or the party that deducts the tax and submits it to the government ). Here’s are the key details that you need to enter in Part I of the form:

- Your name mentioned in your PAN card.

- Your Permanent Account Number (PAN). Failure to provide PAN details will invalidate your declaration.

- Previous Year for which assessment is being done.

- Next, Residential Status will be Resident Indian as NRIs are barred from submitting Form 15G.

- Points 6 to 12 as the address for communication must be entered. Mention your communication address correctly along with PIN code.

- Valid email ID and contact number registered in your name.

- Tick ’Yes’ in the checkbox if the assessment for previous years has been done. Also, provide the most recent year of assessment.

- Estimated income for which you are making declaration needs to be mentioned.

- The estimated income due for assessment in the coming year.

- Estimated income from the previous year (also add figure from column 16).

- For cases wherein Form 15G has been filed during the FY, complete details about the previous declaration and aggregate income needs will be a part of the present declaration.

- For declaration, investment details with investment account number such as term deposit, life insurance policy number, employee code and so on.

To fill Form 15G online, you can reach out to your banking partner. Although the look and feel of the form and how you access it varies from bank to bank, the process to fill it online usually entails the following steps:

- Visit your bank’s net banking page and log in.

- Navigate to the online fixed deposits page that will display your FD details.

- The option to obtain and fill Forms 15G and 15Hshould be available on the same page.

- Start filling out the form, and include details of your deposits and other investments.

Submission of Form 15G & Form 15H

The digitalisation of the submission of Forms 15G and 15H by the Central Board of Direct Taxes (CBDT) and some of the major banks allowing the same has brought much relief.

To submit the forms online the following process must be followed:

- The deductor gets involved in the submission of the form 15G only after you enter the details on your banking portal and submit it online. According to the stipulations set by the Central Board of Direct Taxes (CBDT), the deducting party assigns a Unique Identification Number (UIN) for every self-declaration made by the taxpayer.

- The deductor also needs to assimilate complete details for all the self-declarations, and submit it to the Income Tax Department as a quarterly TDS statement along with all the Unique Identification Numbers (UIN).

Do note that any self-declaration made via Form 15G an only hold for the particular financial year. For any financial year after that, a new self-declaration must be submitted every time. Also, the deductor must retain every Form 15G that is submitted for a period of 7 years according to the rules and regulations set by the Government of India.

Penalty for submitting false or wrong declaration in Form 15G/15H

An important point to note about self-declarations made by the taxpayers is that there is repercussion in case false declarations are submitted. As per Section 277 of the Income Tax Act, a false self-declaration can result in a fine and/or imprisonment. Therefore, do keep in mind that you should only submit your self-declaration through Form 15G if you are eligible.

Here’s what you need to know about the penalties for false self-declarations u/s 277 of the Income Tax Act, 1961.

- For tax evasion through a false self-declaration of an amount that is more than INR 1 lakh, the penalty is imprisonment that can last anywhere between 6 months to 7 years.

- Faulty self-declaration in cases other than the one mentioned above, the penalty is imprisonment that can last anywhere between 3 months to 3 years.

Other useful purposes of Form 15G and 15H

The primary objective of these forms is to stop the deduction of TDS from the interest earned on bank deposits. However, you can also use these forms in other situations.

TDS deduction on income earned from corporate bonds

TDS is deducted from corporate bonds if the income goes beyond Rs. 5000 annually. In this case, Form 15G or 15H can be submitted to request an exemption from TDS deduction.

TDS deduction on withdrawal of EPF

If the EPF amount is withdrawn prior to the completion of five years of service, then it is liable for TDS deduction. However, the withdrawal amount should be more than Rs. 50,000/- to qualify for a deduction.

So, if your EPF balance is more than the threshold and you are withdrawing before the completion of 5 years, then you should fill Form 15G or 15H to claim exemption from the TDS deduction. However, you should fulfil the eligibility conditions mentioned above. Ideally, your total annual income, including the withdrawn EPF balance amount, should be below the tax threshold to qualify for the exemption.

TDS deduction on rent

TDS on rent is applicable from 1 April 2019. If your annual income from rent exceeds Rs. 2.4 lakhs, then it is subject to TDS deduction. However, if your total annual income, including the rent, is under the tax threshold, you can fill Form 15G or 15H to request an exemption from TDS deduction.

TDS deduction on post office deposits

Digital post offices also deduct TDS on the interest earned from post office deposits. You can fill Form 15G or 15H at the post office and request for exemption from deduction if the eligibility conditions mentioned above are met.

TDS deduction on commissions earned from insurance

If the commission earned on insurance exceeds Rs. 15,000 annually, then the amount is liable for TDS deductions. Nevertheless, insurance agents may fill Form 15G or 15H to request for exemption from TDS deductions if their total annual income, including this commission, is under the taxable limit.

Form 15G or 15H are effective ways to gain immunity from TDS deduction on the interest earned from your bank deposits and other types of deposits. As a citizen of India, you should take advantage of this wonderful tax-saving opportunity to save you some precious money.

FAQs – Form 15G & Form 15H

- Are NRIs eligible for self-declaration via forms 15G and 15H?

No. As per the rules and regulations, Forms 15G and 15H can only be submitted by resident Indians, not Non-Resident Indians. - Is it mandatory to submit Forms 15G and 15H to the Income Tax Department?

You don’t need to hand over Form 15G or Form 15H to the Income Tax Department. You can turn the forms over to the deductor who will then submit it to the IT Department. - Is there a possibility of a HUF submitting either Form 15G or Form 15H?

As discussed before in the difference between forms 15G and 15H above, the latter only applies to individuals who have attained an age of 60 years or more. In the case of Form 15G, a HUF is eligible for self-declaration only if they meet the eligibility and certain conditions. - If income is taxable can Forms 15G and 15H be submitted?

You can submit the forms but do inform your banking partner stating that the tax amount on your income is not nil. Accordingly, the bank will implement changes in your self-declaration and deduct TDS. Do note that you must report the entire interest you have earned in your tax return and pay tax (whatever’s is applicable) on it. - I have multiple bank accounts. So, do I submit either Form 15G or 15H at each and every bank?

The rule is that you must submit the form at each and every bank from which you draw an income via interest earned. However, you must note that TDS is applicable only in a situation where the total interest earned across all banks where you hold accounts exceeds INR 10,000. - If I submit Form 15G or Form 15H will my income from interest earned become tax free?

Form 15G or Form 15H is only applicable for taxpayers if certain conditions are met and if the tax on your total income is nil. Also note that for recurring deposits (RD) and fixed deposits (FD), the income earned from interest is taxable. As for the senior citizens who have to submit Form 15H, Section 80TTB grants a standard deduction amounting to INR 50,000 only in cases where income is earned from interest provided by post office deposits, fixed deposits, and deposits held in a co-operative society. - Is my interest income is not taxable if I file Form 15G or Form 15H?

Please be advised that Forms 15G and 15H serves the purpose of a declaration that since tax on the total income you earn is zero, TDS should not be deducted from any interest income. Having said that, for investments such as corporate bonds, fixed deposits, and recurring deposit the income you receive by way of the interest that you will receive is taxable. - Once I submit Form 15G/15H, how long do banks take to process my request?

This is something that you must ask your banking partner. However, it is known that most of the major banks who provide this service process your request in real-time. If not, for exceptional cases, the turnaround time is 1 day. - Is there a time limit for submitting Form 15G/15H?

If you are submitting your form to the bank, there is no due-date or deadline set. But do ensure that you submit it as an when you open a new deposit with your bank and at the beginning of each financial year (April 1st). - For how long are Forms 15G and 15H valid?

Both the forms are valid for 1 year only i.e., the validity runs out at the end of each financial year which is March 31st. If you are eligible, make it a point to submit the forms, preferably at the beginning of the financial year ie., 1st April. Doing this will ensure that TDS will not be levied on any interest income that you will earn.

Tax Related Articles