Table of Contents:

- UAN – Universal account number

- How to register a UAN for a new employee?

- How to generate UAN using Aadhaar card

- How to activate UAN?

- Documents required to get your UAN

- UAN Member e-Sewa Portal Services

- Employee benefits of UAN

- Deactivating old UANs

- Merge multiple PF accounts under one UAN

- UAN customer care details

- UAN – FAQs

UAN – Universal Account Number

UAN stands for Universal Account Number which is a unique 12-digit number assigned to every member of Employees’ Provident Fund Organization (EPFO) to access and manage their PF accounts easily.

Salaried individuals can access and manage their PF accounts on the UAN e-Sewa portal including KYC details and their service details.

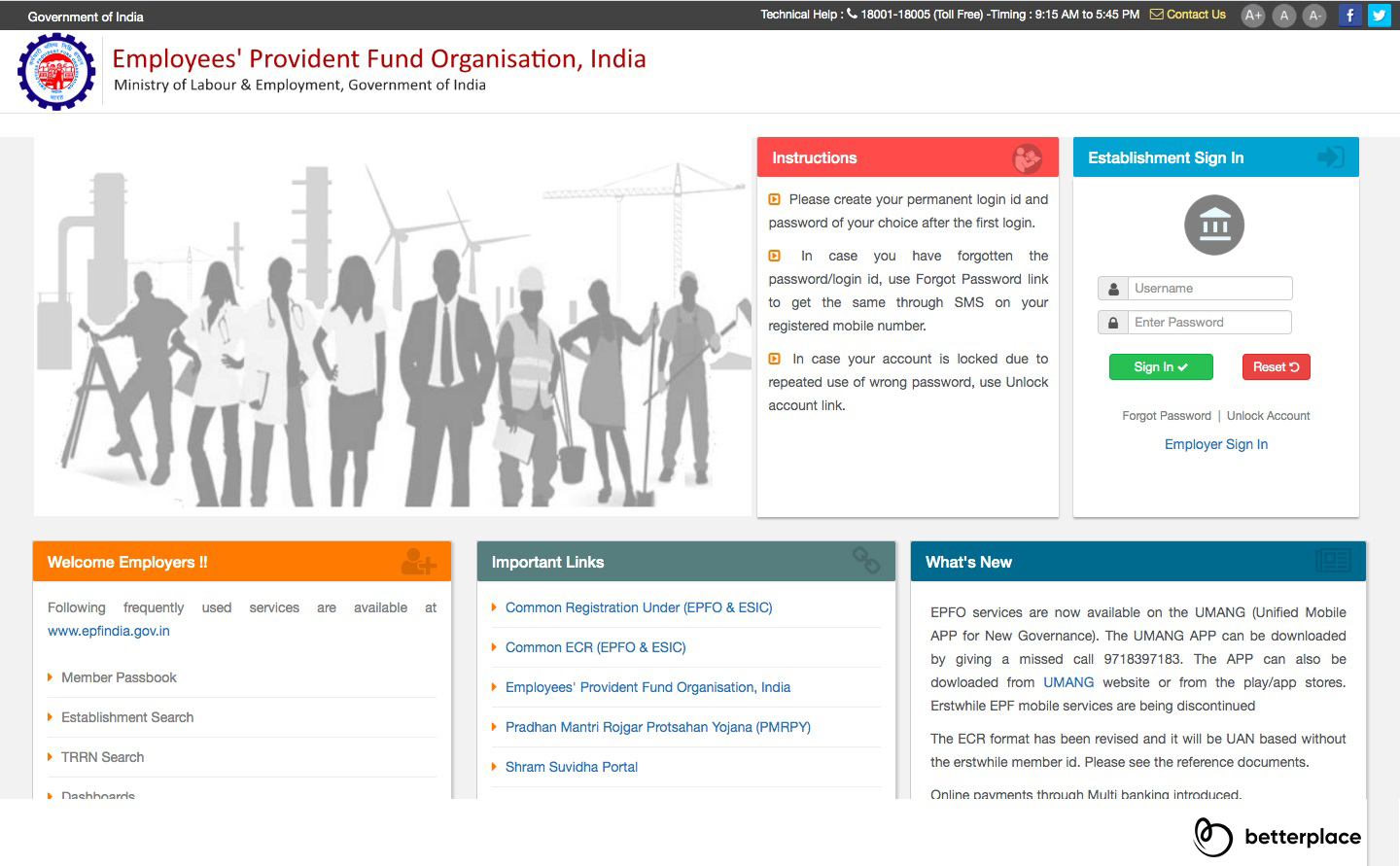

How to register a UAN for a new employee?

Any company with more than 20 employees is required to go through EPF UAN registration online.

For a person who started working for the first time, the establishment has to generate a new UAN by following the below process:

- Go to the employer’s portal.

- Log in with your establishment ID and password.

- Go to the member section and select “Register individual”.

- Enter all the details of the employee like Aaadhar card, PAN and bank details.

- Approve all the details and a new UAN is generated.

- Now this UAN can be linked with the new employee’s PF account by using other EPFO online services.

How to know your UAN?

Checking payslips from previous employment is the simplest approach to locating UAN. The person’s UAN is normally captured on the payslip. The alternative is checking with your previous employer’s Human resources department since they retain a history of your UAN information. The person must select the option of knowing their UAN on the screen.

Importance of UAN to employees

UAN is significant for a number of reasons. They are as follows:

- The distinctive UAN stays the very same till an employee retires.

- UAN is required to verify the payments and credits in the PF system.

- Individuals can use UAN to obtain and transfer cash without depending on their employer.

- Workers can have free access to their PF accounts thanks to online procedures.

- Employees can use UAN to keep track of their monthly deposits. Nevertheless, the employee must be registered with the EPFO.

Advantages of UAN to employees

As a global number, UAN enables the user to consolidate all his PF funds connected with several IDs from various organizations into one location. After authorization, the employee may easily handle several activities with the use of UAN:

- Employees can complete their KYC using UAN.

- He could change the mentioned date of a prior establishment’s leaving.

- In the event of death or retirement, the worker can fill out the candidacy marks from that.

- In the event of a financial emergency, he may file an advance request.

- Employees can transfer prior establishment PF amounts to their current PF account and seek full settlement.

- They can use the site to update their new phone number.

How to generate UAN using Aadhaar card:

Anyone can self-generate a UAN by using Aadhaar card details by using the mobile number registered with UIDAI. The steps are:

- Access the EPF portal for an employee.

- “Online Aadhaar Verified UAN allotment” should be selected here.

- On the next screen enter Aadhaar number and click on “Generate OTP”.

- An OTP would be received on your registered mobile number.

- The next screen would show details of the user based on the Aadhaar number. User can modify any details s/he wants.

- User clicks on “Register” and a new UAN are generated and allotted to the user.

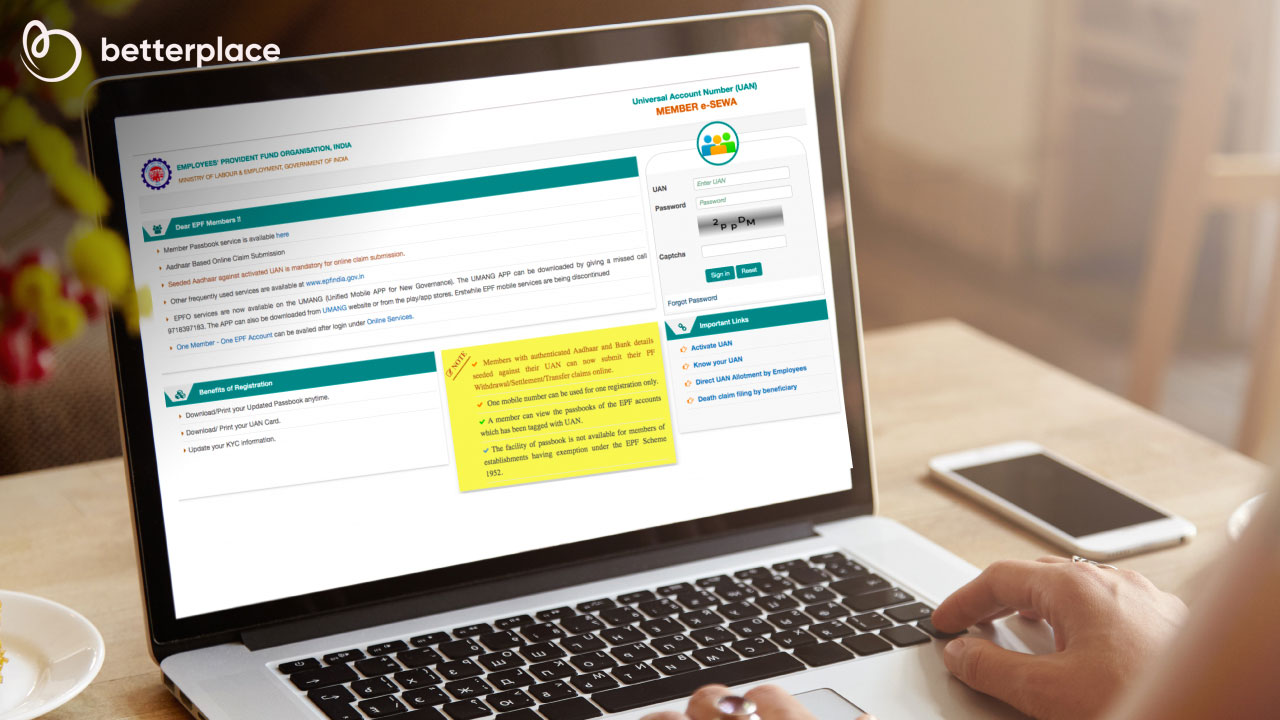

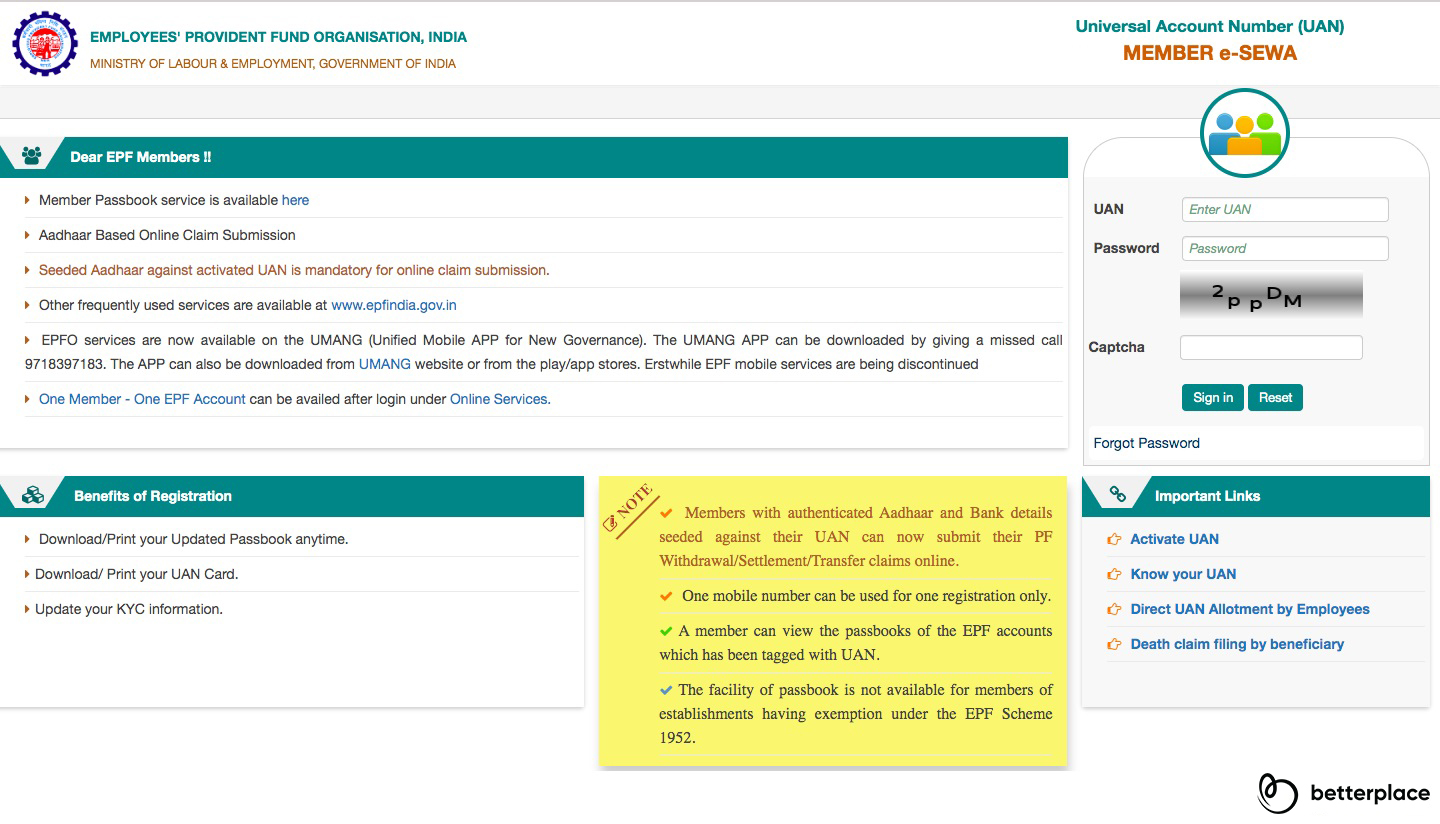

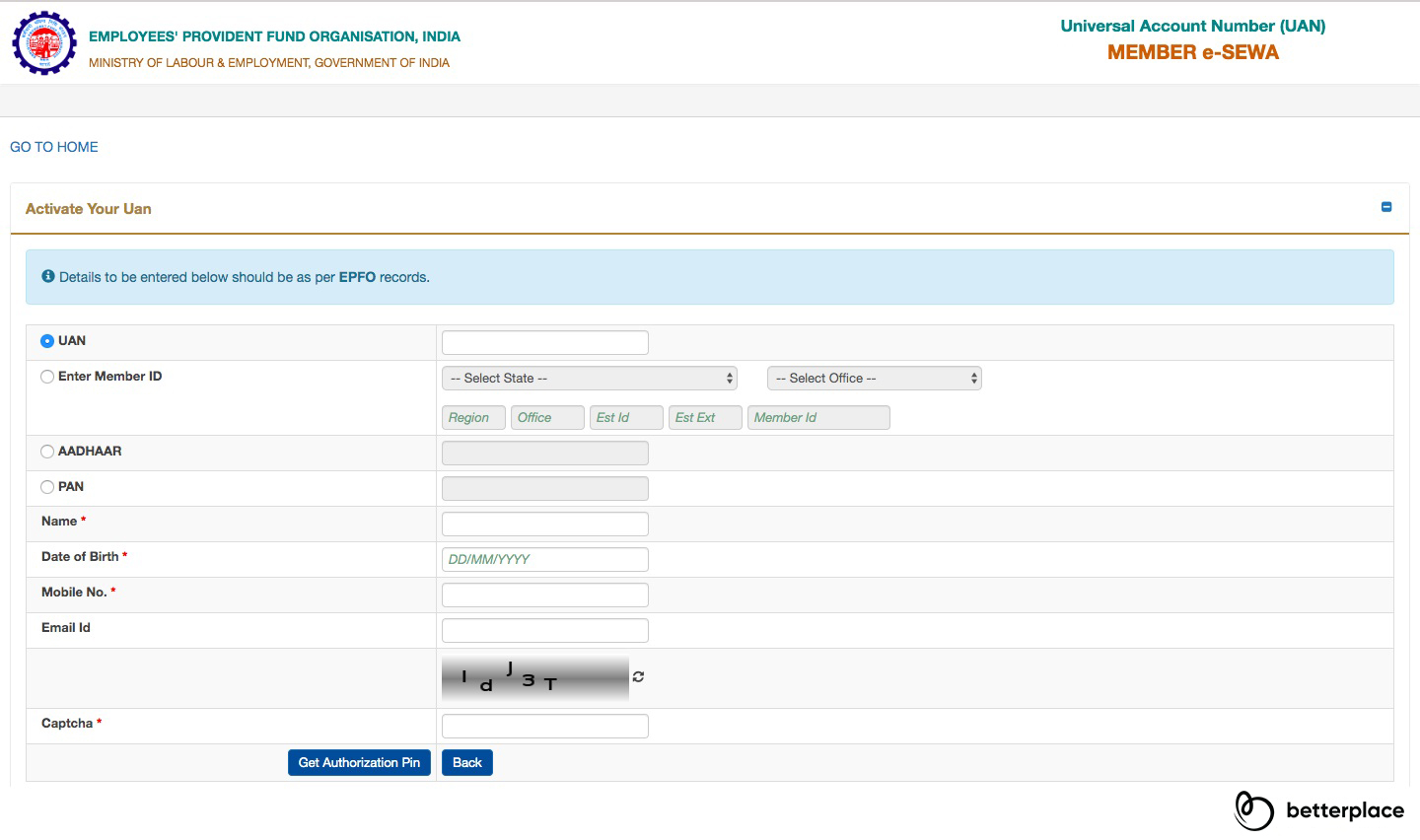

UAN login process for employees: How to activate UAN first to sign in

To activate a UAN, one has to do the following:

- Go to Member Home.

- Click on “Activate UAN” link under section “Important Links” on the right-hand side corner.

- On the next page enter all the mandatory fields and click on “Generate Authorization PIN”.

- Enter the PIN received on your registered mobile number and click submit. system-generated password would be sent to your mobile number.

- You can now login by entering the new password received.

- It is recommended to change this system-generated password.

Mandatory documents required to get your UAN

Now that you have joined your new company, you’ll have to furnish some of your documents to get your Universal Account Number (UAN). These are:

- (ESIC) Employees’ State Insurance Corporation card

- Banking information: Bank account number, IFSC code, and branch name

- PAN card: Ensure that it is linked to your UAN

- Aadhaar card: A mandatory document for identification; ensure that your mobile number and bank account are linked to your Aadhaar

- Proof of identification: Any national identity proof of identification with affixed photograph such as driving license, passport, Aadhaar card, voter ID etc.

- Proof of address: any ID proof with address, rental agreement or utility bills in your name

UAN Member e-Sewa Portal Services

If a UAN has been assigned, an employee can log into the EPFO portal and access a host of UAN services under 4 segments, viz.: View, Manage, Account, Online Services.

Let’s take a look at each.

A) View

Under this segment, you can:

- Check your ‘PROFILE’ which will contain your personal information available with EPFO. You can also edit certain details.

- View your ‘SERVICE HISTORY’ with all employers till date in chronological order.

- Preview and Download your ‘UAN CARD’.

- View and download your EPF ‘PASSBOOK’.

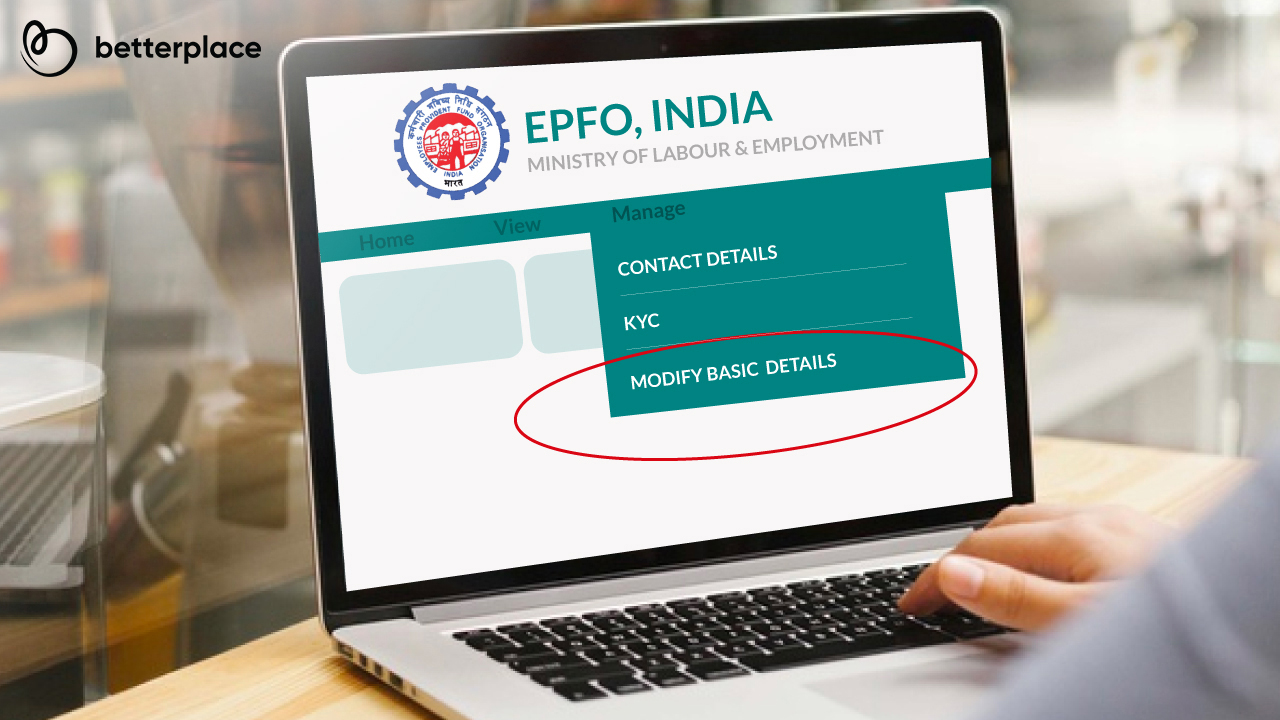

B) Manage

As the name suggests, this tab lets you modify personal information such as:

1) BASIC INFORMATION

2) CONTACT INFORMATION

Email ID and mobile number can be changed under this segment.

3) KYC

You can upload KYC information and documents such as Aadhaar Card, Bank Account, PAN etc.

4) E-NOMINATION

Update/Enter nominee information.

5) MARK EXIT

Update date of exit while changing jobs.

C) Account

Under this segment, you can ‘CHANGE PASSWORD’ for your EPF member account.

D) Online Services

Conveniently access various EPFO offerings which were complex in the past.

- CLAIM (Form-31, 19, 10C & 10D)

Can be used to partially or fully withdraw PF funds online. However, your UAN must be linked with your Aadhaar.

- ONE MEMBER – ONE EPF ACCOUNT (TRANSFER REQUEST)

Members can transfer PF funds from the previous to the current employer. Bear in mind that KYC must be updated and correct. Also, only one transfer request can be made, that too for the last PF account.

- TRACK CLAIM STATUS

If a claim has been registered for the withdrawal of funds, this option can be used to track its progress.

- DOWNLOAD ANNEXURE K

This document contains member details, such as service history, PF accumulations with interest, date of joining(service), date of exit, and member IDs from the past and present. It is used by PF trust(or field office) to expedite the transfer of PF accounts.

The applications of UAN

The employees are not the only ones to proffer from UAN. Here are some of the applications of UAN:

- With the introduction of the UAN, the early and untimely withdrawal of PF has dipped

- The EPFO, with the help of UAN, can track the employment history of an individual

- Authorities can now centralise all-India employee data with the help of UAN

- EPFO can now retrieve employee bank details and KYC without involving the employer

- Employee verification, which was previously a hassle to process, is now simpler

The employee benefits of UAN

Perhaps the biggest benefactor of the introduction of UAN is the employee. Here are a few of the advantages of UAN for the employees.

- A single UAN be the roof under which multiple PF accounts will be unified

- With the help of UAN, an employee can partially or fully withdraw PF amount

- PF statement can be viewed and downloaded instantly either via the portal or an SMS

- Transferring PF funds from one account to the next is now easier for employees with UAN

- A new employer need not re-verify UAN KYC and Aadhaar if it’s already verified by the previous employer

- Employees can keep tabs on the PF contributions made by their employers

- The provision of UAN ensures that employers do not have the upper hand; they cant neither access employee PF details nor withhold PF funds belonging to the employee

Deactivating old UANs

When the employer changes, an employee gets a new Member ID; this happens in the event of a job switch — new employer, new Member ID for the employee. However, UAN remains the same.

The case of multiple UANs occurs because of the following reasons:

- The employee has some issues with the past employer and doesn’t want the new employer to know about it. Usually happens during job switch where the employee must provide his or her UAN to the current employer. When this doesn’t happen, the employer assigns a new UAN to the employee.

- The ex-employer does not mention or update the last working day (date of exit) of the employee in the Electronic Challan and Return (ECR).

In the event of more than one UAN being assigned, it is the employee’s responsibility to deactivate old UANs and transfer all the funds under the new UAN.

Here are 2 ways an employee can merge UANs.

- The Ideal Approach

This method of deactivating old UANs is ideal as compared to the other approach mentioned below for two reasons: automation and speed. Here’s what you have to do.

Step 1: Employee must submit a request for merging PF accounts under the current (new) UAN. The method is clearly explained in detail under the heading ‘’Merge multiple PF accounts under one UAN’’.

Step 2: Once a request is submitted, the EPFO automatically picks out the older UANs in several phases.

Step 3: As soon as the identification phase is complete, the older UANs will be deactivated.

Step 4: Upon deactivation, the funds under the older UAN will be moved to the new UAN and the EPFO member (employee) will be intimated about the deactivation via SMS.

Step 5: The member will also receive a request from the EPFO to activate the new UAN if it has not been activated.

Note: UAN will be auto-populated in the Electronic Challan and Return (ECR) if the member is set to receive EPF arrears from ex-employers. Upon completion of this step, the arrears will show up under the new UAN.

- The ‘Other’ Way of Linking UANs

Try to go for the first technique as the time required is less as compared to the following method which must be approached as follows:

Step 1: Intimate either the (current) employer or the EPFO about the existence of multiple UANs.

Step 2: Write an email to [email protected] from your registered email ID clearly stating your intention — to merge UANs — and the UANs.

Step 3: EPFO will carry out verification to address your request.

Step 4: Upon completion of verification, the old UANs will be deactivated.

Step 5: To transfer the EPF accounts from the older UANs to the new, individual claims must be submitted.

Merge multiple PF accounts under one UAN

The EPFO now allows employees to consolidate all the PF accounts and funds under each. With the help of this facility, an employee can merge up to 10 PF accounts under one UAN. The ‘One Employee – One EPF Account’ service can be availed in the following manner.

What is required for this facility?

You need to fulfil the following criteria if you desire to avail this service.

- You need a UAN

- Your current EPF account must be linked to your UAN

- KYC must be completed and verified by your current employer; includes bank account number, PAN card number, Aadhaar number, and IFSC code

- UAN has to be activated. A waiting time of 3 days to access this service post activation of UAN

Merging PF accounts: The process

Following is the process of merging PF accounts under one UAN if the above requirements have been fulfilled.

- Step 1: Visit the EPFO portal

- Step 2: Click on ‘For Employees’ under ‘Our Services’ tab

- Step 3: Then click on ‘One Employee – One EPF Account’ link

- Step 4: Enter details and then hit the ‘Generate OTP’ button. An OTP will be sent to your registered mobile number that is linked with your UAN

- Step 5: Enter your old EPF id, accept the declaration and click on the ‘Submit’ button

Other information on UAN member portal:

There is a lot of information one can view using the EPFO online services by logging into the UAN portal. Enter the Username, password and login through the EPFO member login screen.

Once logged in one can view the following information from the “View” tab:

- Full EPF profile like UAN, Name, Birth Date, Gender, Aadhaar, PAN, Bank Account Number, Mobile Number and Email can be seen.

- You can only edit your mobile number and email ID on this screen.

- Service history tab would show details like establishment name, establishment ID, date of joining and date of Exit of both EPF and EPS.

- UAN card is downloadable for offline PF withdrawal.

- EPF Passbook can be accessed under the “view” tab.

One can manage the following information from the “Manage” tab

- Email id and registered mobile number can be added or edited.

- KYC details can be uploaded.

Under the “Online Service” tab one can avail the following:

- Claim a full or partial withdrawal of PF with the help of forms 31, 19 and 10C.

- Transfer PF amount from the previous account to the current provided:

KYC details are updated against the UAN.

Your previous and current bank account details exist against your UAN. - Track status of EPF claim status.

UAN customer care details:

For any issues related to EPF portal, one can reach out to the UAN helpdesk via any of the following methods:

Call toll-free number 1800 11 8005 between 9.15 Am to 5.45 PM

Email to [email protected].

Going to the website Employees’ Provident Fund Organisation and raising an issue.

Contact any of the regional offices listed at Contact Us

The final word

UAN has made it easy for the organization as well as employees to transfer and withdraw PF. All PF accounts of any individual are linked in a single framework for easy access.

Frequently asked questions about UAN

1) During a job change, what happens to an individual’s UAN?

The employee UAN remains the same at all times. While changing a job, If UAN is allotted by previous employment, all the employee has to do is provide the UAN to the new employer. Once UAN is provided, the employer links the UAN with a new member ID.

2) Are there cases where more than one UAN exists?

Yes, this might happen for multiple reasons. Especially when the UAN is submitted to the previous and the current employer. In such a case, the employee must alert the EPFO helpdesk and provide both the UANs. Once the verification process is completed, the older UAN will cease to exist.

3) What is the UAN helpdesk number if employees have any queries?

Employees can contact the EPF portal helpdesk number 1800-118-005 in case of any queries.

4) As an EPFO member, what are the other facilities you’re entitled to?

At present, an EPFO member can do the following:

-

- View/download EPF passbook

- Enter KYC details for verification

- Edit personal details

- View Member IDs assigned by previous employers

- Download/view EPF card

- Track/Submit EPF claim

5) What is the reason behind linking of UAN with Aadhaar card?

Aadhaar card and UAN are linked so that employees can submit and receive claims in the shortest time possible. By doing this, they can ensure that there is no need for attestation required from the employer a the time of submitting a claim. Moreover, any evidence for the partial withdrawal of funds — for an event such as marriage, or for medical or educational purposes — need not be submitted to the EPFO.

6) How do I download or view my UAN card?

Here are the steps if you want to download or view your UAN card:

Step 1: Open EPFO portal and navigate to the member’s login page

Step 2: Sign in with your UAN and password

Step 3: Then under ‘Download’ click on ‘Download UAN Card’

Step 4: Take a printout of the UAN Card or Download it

7) Can an EPFO member change his/her email address or phone number?

Yes, you can. To change it, log in with your UAN password and navigate to “Profile”. Then select the option ‘Edit Email ID’ or ‘Edit Mobile Number’ and follow the necessary steps.

8) Can an EPFO member upload more than one KYC document?

Yes. EPFO member can upload multiple KYC documents. However, the documents must be out of the 8 specified KYC documents.

9) Is there a way to know the status of the employer’s approval for the KYC uploaded by an EPFO member?

Yes. The status (of the employer’s approval) will be right next to the KYC document that has been uploaded.

10) Will a member have to get a new UAN number and activate it every time in case of change of job?

Members do not have to get a new UAN number. It’s a one-time number that is assigned permanently no matter how many employers you change.

Related Articles on EPF